Discover a New Destination: Dubai

Deprecated: Creation of dynamic property WP_Block::$attributes is deprecated in /home/.sites/109/site1015272/web/web/wp-includes/class-wp-block.php on line 179 Deprecated: Creation of dynamic property WP_Block::$attributes is deprecated in /home/.sites/109/site1015272/web/web/wp-includes/class-wp-block.php on line 179 Deprecated: Creation of dynamic property WP_Block::$attributes is deprecated in /home/.sites/109/site1015272/web/web/wp-includes/class-wp-block.php on line 179 Deprecated: Creation of dynamic property WP_Block::$attributes is deprecated in /home/.sites/109/site1015272/web/web/wp-includes/class-wp-block.php on line 179We all remember the Covid-19 pandemic and with it the long weeks of lockdowns and travel restrictions. One of the few countries worldwide which managed the pandemic differently compared to other countries was the UAE , more specifically the emirate of Dubai. The ruler of Dubai, H. E. Sheikh Mohamed bin Rashid Al Maktoum decided in early 2020 to keep the borders open, to not to impose a lockdown and allow long-term and short-term visitors to come to Dubai. The positive results of his crisis management were visible not only during the pandemic, but they are visible today.

In the first half of 2018, Dubai saw 111 billion AED (ca. 30 billion USD) worth of real estate transactions. Without a doubt, this is still a big number but not much if we compare it with the 528 billion AED (ca. 144 billion USD) of real estate investments in 2022, quoting figures from Dubai Land Department (DLD). It is expected that this year’s result will exceed 500 billion AED from last year.

Consequentially, we from The Loft Bureau International Realty have decided to include the UAE and especially the two emirates of Dubai and Abu Dhabi into our curated list of hot real estate markets. In this blog, we will explore the various reasons why Dubai is the perfect place to invest in real estate this year and the opportunities that await investors. Whether you are a seasoned investor or a first-time buyer, read on to discover why Dubai should be on your investment radar this year.

Central Location

Dubai, and indeed the UAE, sits in a very strategic location on the world map. It is roughly a six-hour flight from most of the major cities in the East and the West, offering a convenient waypoint for those who are crossing the globe and serving as a hub for local businesses who want to expand in either direction.

Booming Tourism Industry

Dubai’s tourism industry has been on the rise for the past few years, with the emirate attracting millions of visitors each year. In 2022, Dubai welcomed over 23.7 million travelers, up 89% from the previous year, making it one of the top tourist destinations in the world. This doesn’t come as a surprise. With world-class attractions such as the Burj Khalifa, Palm Jumeirah and some of the most well-reputed hotels in the world, there is no shortage of wonders to experience and as the tourism industry continues to grow the demand for short-term rental properties, including hotels, serviced apartments, and holiday homes is constantly increasing. This presents an excellent investment opportunity for real estate investors looking to capitalize on the thriving tourism industry.

Dubai – an innovation hub with a robust economy

Dubai has always been open to innovation and creative minds. Keep in mind that the city was built on the vision of its ruler Shaikh Mohamed bin Rashid Al Maktoum who has always been a big supporter of new technology and innovative engineering.

This “open-minded” ideology by Dubai’s government is reflected in many ways: in the new communities which are being developed to create a more sustainable living experience for residents, new roadways which are being constructed to keep the city better connected, and with the many ongoing ‘smart city’ and ‘happiness’ initiatives. There are also many architectural innovations, such as Dubai Creek Tower, which will eventually dwarf the Dubai Frame, the 150-meter tall ‘photo frame’ tower that creates a visual link between the older and newer parts of the city.

Strong Regulatory Framework

Dubai has learnt from its mistakes in the past. In the early days of Dubai many investors lost parts or all their funds with real estate investments especially in the years 2008/2009 in the light of the global financial crisis. Today, the situation presents itself differently. (Foreign) Investors and end-users find themselves protected by a strong framework of laws and regulations. With the implementation of the Dubai Land Department and its regulatory body, the Real Estate Regulatory Authority (RERA), Dubai’s government created a strong system to protect the clients’ interest.

Dubai’s Golden Visa

Dubai’s government recently introduced a 10-Year Investor visa, this definitely can be considered as a major gamechanger for the emirate. Granting investors such a long-term residence option shows the level of confidence that Dubai has in investors and signifies just how secure an investment into the city ultimately is. However, this visa is not only granted to real estate investors but also to highly skilled employees, further supporting the attractiveness of Dubai for international companies. This recent change goes in line with the recent announcement that businesses in the UAE would no longer require a majority shareholder of local nationality, which will undoubtedly lead to a rise in entrepreneurship and homegrown businesses.

Tax Free Environment

The gulf countries were always known as tax-friendly countries. This hasn’t changed. And so, Dubai’s tax-free status has transformed it into a haven for wealthy investors worldwide who are seeking secure and lucrative investment opportunities. With no taxes on income including rental income, or capital gains, Dubai offers a unique opportunity for investors to build and grow their wealth.

Safe and Stable City

Dubai is known worldwide as one of the safest cities to live in and therefore attracts people from all walks of life. A very low crime rate and an efficient legal system are pushing many foreigners to permanently move to the gulf emirate. Dubai’s stable political climate is also a significant factor that contributes to its safety and security. A fact which is highly appreciated by foreigners especially those who had to leave their home country because of political turmoil and war.

Strong Rental Market

Dubai’s population is growing mainly due to the high influx of expatriates of which many prefer to rent their accommodation making it an ideal investment destination in 2023. The strong demand for rental properties, including apartments, villas, and commercial spaces is supporting a strong rental growth. According to Bayut’s recent report, the average rental yield for apartments in Dubai ranges from 6% to 8%, and this is not expected to change any time soon. In addition, the thriving tourism industry contributes to the high demand for short-term rental properties like holiday homes and serviced apartments.

Attractive Market Rates

Although Dubai is a global destination, its property prices average far below the prices in other major cities such as London, New York, and Singapore. According to various sources the average price per square foot for prime residential properties in Dubai is around 820 USD, compared to 2,000 USD in London and 1,900 USD in New York. As a result, investors can acquire prestigious real estate in Dubai at a portion of the cost a similar property would have cost them in another major city. This combined with the high quality of residential products now available in the upper echelons of the market, is cementing Dubai’s position as one of the world’s leading second homes markets.

World class projects and developers

Dubai’s skyline is dominated by one of the world’s tallest towers Burj Khalifa. Another famous building in Dubai is the iconic Burj Al Arab Hotel, a hotel that has been the epitome of luxury hotels for many years. The city is known for having world-class developers that are responsible for creating some of the most iconic and luxurious properties in the world. These developers are known for their innovative designs, high-quality construction, and attention to detail, which makes them highly sought after by investors and homebuyers alike.

Additionally, these developers are going with the time and recently committed themselves to build sustainable projects, which means that their projects are designed to be environmentally friendly and energy-efficient, making them attractive to investors who value sustainability.

Final thoughts

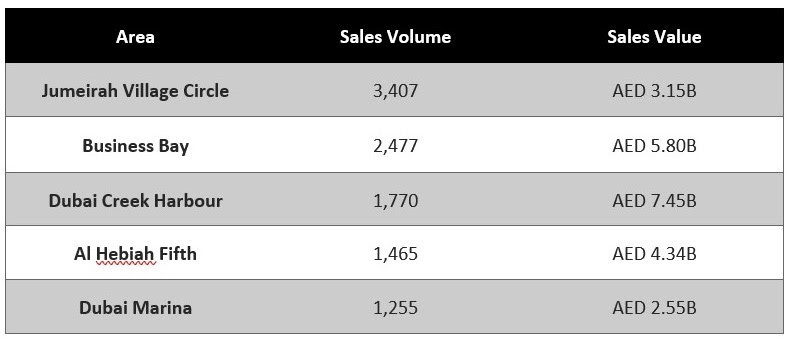

In summary we can see that Dubai offers a combination of factors that make it an ideal location for real estate investment. So, it came as no surprise that Dubai’s real estate market exhibited remarkable growth during Q1 2023 and does not show any signs of slowing down. According to the latest information released by Dubai’s Land Department transactions valued at 88.7 billion AED (ca. 24.6 billion USD), involving 30,898 sales, were completed during the first three months of 2023, representing a 6% quarterly increase and a 51% year-on-year surge. The market was driven by strong demand for both ready and off-plan properties, especially in the luxury segment.

In general, it is widely expected that annual growth for 2023 will moderate to 13.5% – outperforming other global cities by far. The market fundamentals remain unchanged however, and a return to steady and sustainable growth will put confidence in homeowners and investors alike. It is important to note here that most of all transactions are being paid for in cash, currently accounting for ca. 80% of the total value of all transactions. This number is expected to rise further during the year. As mortgage rates have also risen in the UAE, the mainstream market may take a hit. However, with cash purchasers dominating Dubai’s luxury residential market, it’s unlikely we will see demand decrease in this segment.

The team at The Loft Bureau International Realty assumes that Dubai is poised for even more significant growth in the coming years. Regardless of whether you are an experienced real estate investor or new to the field, Dubai has something to offer, and our team is available for you to assist you in all aspects. Together with our partners in Dubai we have a vast range of ready and off-plan properties on hand to satisfy even the most sophisticated client. Take advantage of the current real estate market and experience the benefits of owning property in one of the world’s most sought-after destinations.